The Bottom Line

- The FTC settled charges with FloatMe, a subscription-based online cash provider, related to discriminatory cash advance practices, negative option subscriptions, dark patterns and baseless claims around algorithmic underwriting.

- This action provides a reminder that companies should pay attention to consumer complaints and work promptly to address any concerns.

- In what is an apparent first from the FTC, the order required the defendant to maintain records of consumer testing, including A/B and multivariate testing.

Online cash advance provider FloatMe Corp. will pay $3 million as part of a settlement with the Federal Trade Commission (FTC) for allegations of unfair and deceptive tactics against customers. The settlement, announced January 22 by the FTC, came after the subscription-based business was charged with violating the FTC Act, the Restore Online Shoppers’ Confidence Act (ROSCA) and the Equal Credit Opportunity Act (ECOA).

Under the settlement order, FloatMe and its founders agreed to pay the FTC $3 million to refund customers. The order also prohibits the company from making deceptive marketing claims, including mispresenting its use of an algorithm or artificial intelligence, and requires the company to obtain consumers’ express, informed consent for charges, simplify the cancellation process and institute a fair lending program.

Lastly, demonstrating its commitment to consumer fairness and transparency, the FTC’s order requires FloatMe to create and maintain records of consumer testing, including A/B and multivariate testing, which are real-time experiments that companies can use to steer consumer behavior.

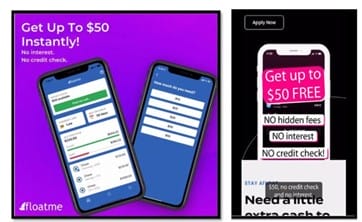

The FTC’s initial complaint alleged FloatMe promised customers that they could instantly access up to $50 in cash advances as part of their membership, but failed to deliver the promised advance amounts, used dark patterns when customers tried to cancel their membership and discriminated against customers who receive public assistance. The FTC also charged FloatMe with making baseless claims that cash advance limits would be increased by an algorithm.

False Promises

The complaint alleged that FloatMe charged customers $1.99 per month to join the app, and promised customers that they could instantly access up to $50 in cash advances as part of their membership, including “emergency funds” for “free” “within minutes.” Customers actually were only able to access $20 in advances when they signed up and had to wait up to three days for promised funds, unless they paid a $4 fee to receive cash “instantly.”

In its complaint, the FTC cited consumer complaints as evidence of this deception, including:

- “[t]he app is not very helpful for my finances because I’m not paying a $4 fee to get a measly $20 instantly deposited in my account.”

- “[the app is] pointless. They said I could use $20 then wanted to charge $4 in order for me to have instant access to it otherwise it would be 2-3 days before it got to my account then the money is due in 5 days from the point you asked for it.”

- “V[ery] FRUSTRATED” because the “$20 OFFER [was] cut to $16 after [a] surprise $4 FEE at [the] last second.”

Cancellation Procedures

The FTC continues to enforce its prohibition against using dark patterns and tricks to make it difficult for consumers to cancel subscriptions. In its complaint, the FTC cited numerous problems and delays in FloatMe’s cancellation process, including a system that refused cancellation requests without informing the customer of the decision — and the issues persisted despite customer complaints. The FTC found it particularly troublesome that one of FloatMe’s founders acknowledged in an internal communication that the cancellation process “make[s] it difficult for someone to quit.”

The FTC complaint cited messages FloatMe received from its customers expressing frustration with the company’s practices, including:

- “I downloaded the app for this company. I was not eligible for loans so I canceled my membership . . . . They have continuously charged me monthly, I have canceled my subscription three times on the app, emailed them three times, received responses confirming cancellation, and they are still charging me monthly.”

- “I closed my account several months ago but I woke up yesterday to my account going negative because they billed me for a subscription. . . and it’s nearly impossible to get a hold of anybody in customer service. Scam company.”

- “I was told the solution to cancelling the membership was a link I could click to fill out a cancellation form, once I clicked the link the page was expired and I have absolutely no way to get them to stop charging me money. I downloaded this app because I was struggling and needed help and all it has done is make things worse and never offer remedy.”

Discriminatory Practices

In violation of the ECOA, FloatMe illegally discriminated against customers who received public assistance like Social Security, military and unemployment benefits. FloatMe did not consider income received through these programs in determining whether a consumer was eligible to receive an advance, and it declined advances to customers whose income came from public assistance. FloatMe nevertheless charged these customers for monthly subscriptions, even though they could not access the main services.

The FTC cited instances of consumer deception on this point – for example:

- “I get social Security and I’ve been paying that $1.99 or whatever it is you’re charging me and haven’t been able to get a [cash advance] so if you can’t float me the $20 that it offered and refund me my money and cancel my membership I’m not paying you for nothing.”

- “Your service always denies me because I am disabled and get a steady monthly income from social security once a month since 2012, but according to you[], I have no valid income history.”

Misrepresenting the Use of Algorithms

FloatMe told customers who requested a larger cash advance amount that their advance limit could be increased by an algorithm over time. However, the FTC alleged that cash advance limits are not “automatically” increased by an algorithm, but instead increased manually by FloatMe’s support team only in limited instances, based on undisclosed criteria and only upon an explicit consumer request.

In its complaint, the FTC referenced numerous consumer complaints, including:

- “I have been using this app faithfully for a few months now and I bring in way over [$]1,000 every 2 weeks but my borrow amount has never increased. I’ve read the FAQS and it said your borrowing amount increases as long as your income is consistent and your [sic] paying the money back in a timely manner and I have been doing both so why hasn’t my amount increased?”

- “[FloatMe] said it wouldn’t take long for an increase. . .$20 not to [sic] much help.”